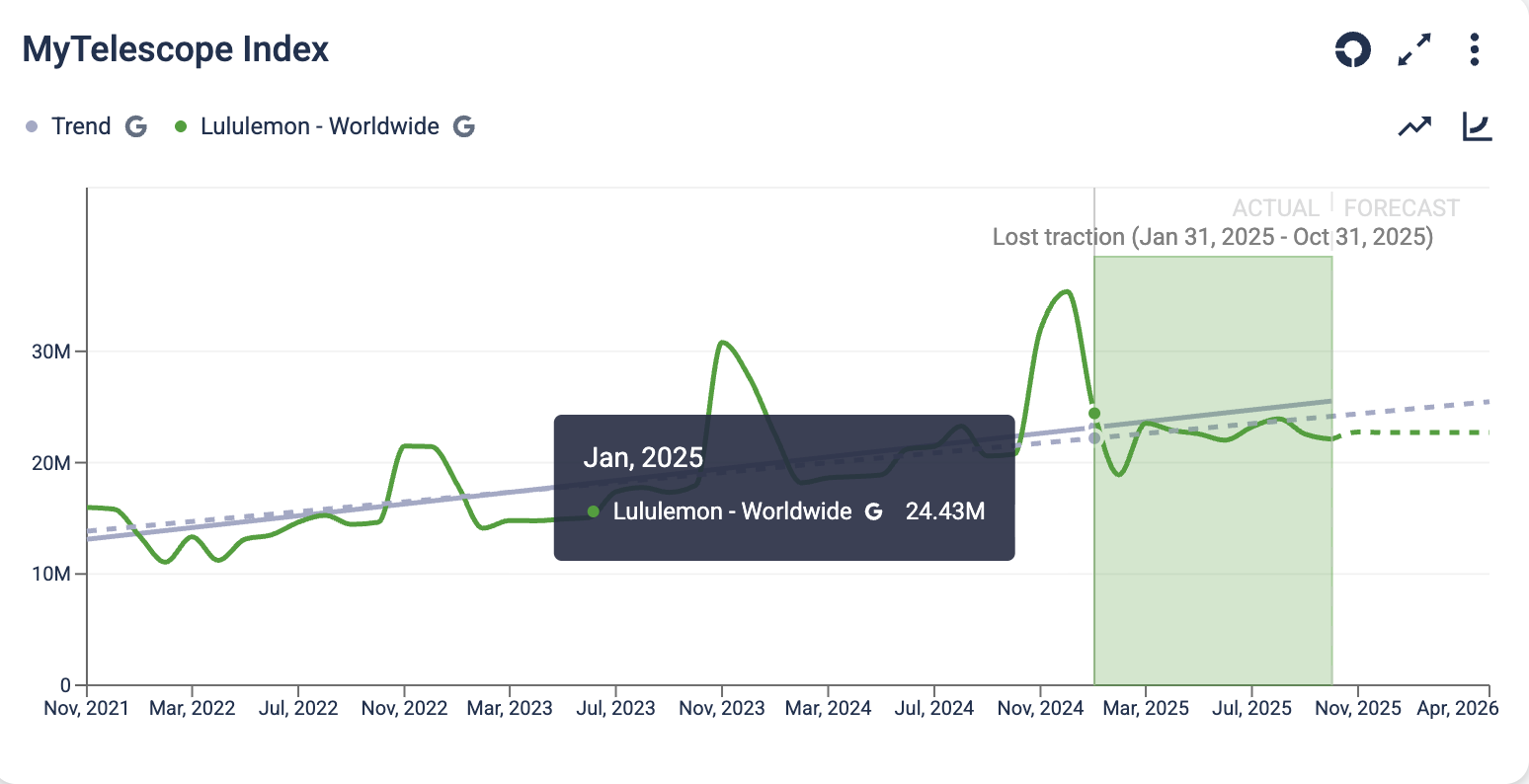

Market Outlook: Lululemon Brand Interest Down 9.5% Premium Demand Under Pressure

Lululemon’s brand interest has dropped about 9.5 percent this year. The decline, measured by search activity,.

That is a meaningful contraction for a brand that has long defined the premium end of athletic apparel.

This is not a collapse, but a warning sign. Demand signals point to a change in how consumers think about value, style, and performance in the category. Search data shows a sharp rise in queries like “on sale Lululemon,” which climbed from 3,600 in January to 110,000 by October, a jump of nearly 3,000 percent. This indicates growing price sensitivity even among loyal buyers.

At the same time, competitors such as Alo Yoga are gaining traction. Brand interest for Alo Yoga is up about 5 percent in the same period, supported by a strong connection to lifestyle and fashion. Alo’s growth reflects a shift from function-first to style-first motivations in the activewear market.

The reasons behind this shift are both strategic and structural. Mark Ritson described it as “Gapification,” the erosion of differentiation that turns a once-distinct brand into a generalist. In practice, Lululemon’s product extensions and broader distribution have made it more accessible, but also more replaceable.

This is happening before AI-driven discovery truly takes hold. Once recommendation engines and personal shopping agents become the default path to purchase, brand distinctiveness will matter even more. If algorithms do not see a reason to rank Lululemon higher, the brand risks being filtered out of the consideration set entirely.

In short, Lululemon remains the performance leader, but the market narrative is changing. The brand that once owned “technical luxury” now faces a consumer base seeking either value or fashion. The middle ground it created may no longer hold.

For investors and marketers alike, this signals a broader truth: premium positioning must now be re-earned through clarity of product, proof of value, and emotional relevance. The next growth phase will belong to brands that know how to turn those qualities into search and conversation pull before the algorithm decides who gets seen.

Facts & Signals (MyTelescope MAPS)

Facts & Signals (MyTelescope MAPS)

Magnitude

• Lululemon brand interest declined around 9.5 percent year-to-date.

• Alo Yoga increased its Share of Search by about 5 percent over the same period.

Acceleration

• Rising search activity around discounts for Lululemon points to growing price sensitivity.

• Alo Yoga continues to build steady momentum driven by lifestyle and aesthetic demand.

Pattern

• The activewear category is moving from performance-led to style-led demand themes.

• Premium and exclusivity queries are decreasing while lifestyle and value intent are rising.

MyTelescope View

The premium activewear market is redefining what “value” means. Performance leadership alone no longer guarantees pricing power. Lululemon’s next phase depends on restoring distinctiveness before AI-driven discovery reshapes visibility and consumer choice.

See the full dashboard here:

Or create your own market view here